Vehicle property tax calculator

Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. It accrues at a rate of 5 percent for the remainder of the month following the date in which the.

Personal Property Tax Jackson County Mo

Part of the reason taxes are so low is that owner-occupied.

. Compared to the 107 national average that rate is quite low. Delinquent business or personal property tax and watercraft tax may be submitted to AFCS for collection. Kansas Vehicle Property Tax Check - Estimates Only.

Vehicle Property Tax Calculator Estimate vehicle property tax by makemodelyear or VIN. Pay Your Personal Property Taxes Online. Use this calculator to compute your 2022 personal property tax bill for a qualified vehicle.

Find out how much tax you can expect to pay for your new car. Kenya Vehicle Import Duty Calculator Calculate KRA Motor Vehicle Importation Taxes and Levies using Current KRA CRSP 2022 Ani Globe. Vehicle Tags and Titling What you need to know about titling and tagging your vehicle.

Please input the value of the vehicle the number of months that you owned it during the tax year and. Vehicle Property Tax Estimator Please enter the following information to view an estimated property tax. Calculate State Sales Tax.

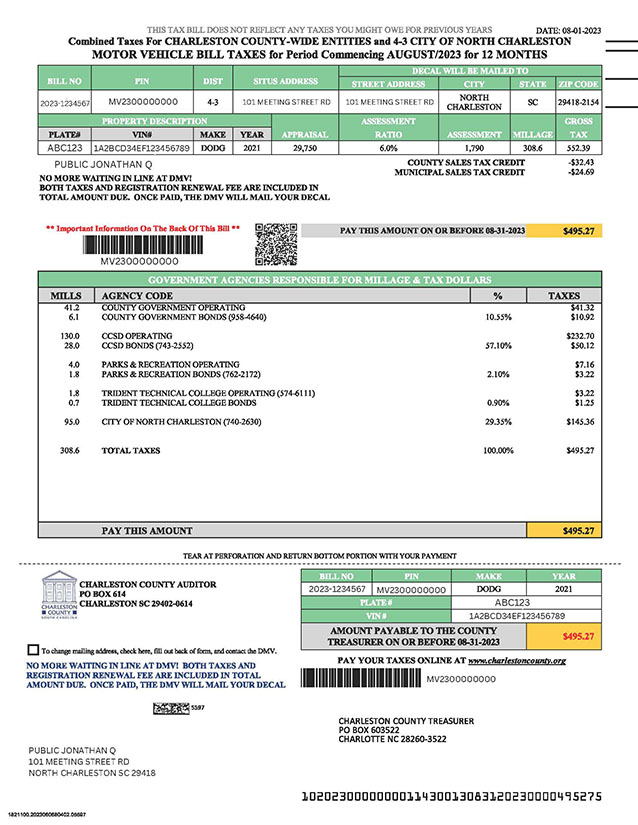

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. Find your county look up what you owe and pay your tax. The average effective property tax rate in South Carolina is just 055 with a median annual property tax payment of 980.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. Interest is charged on late vehicle property tax payments and on late registration renewals. Payment shall be made to the motor vehicle owners County Clerk.

Vehicles are also subject to. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. You can contact them at 888-317-2327 ext.

The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred.

The states average effective property tax rate is just 053. Please input the value of the vehicle and the number of months that you. Vehicle Value Tax Calculator.

Use this calculator to compute your 2022 personal property tax bill for a qualified vehicle. Homeowners in Nevada are protected from steep increases in. This calculator is designed to estimate the county vehicle property tax for your.

Car Tax By State Usa Manual Car Sales Tax Calculator

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Office Of The Tax Collector City Of Hartford

Dmv Fees By State Usa Manual Car Registration Calculator

Property Tax Calculator

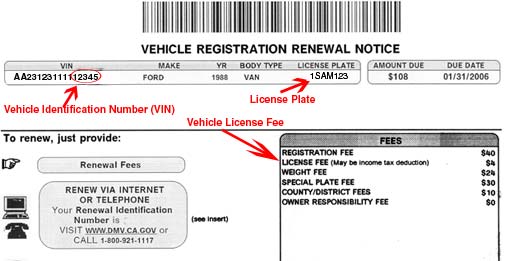

Vehicle Registration Licensing Fee Calculators California Dmv

Sample Motor Vehicle Tax Bill Charleston County Government

Your Top Vehicle Registration Questions And The Answers Adot

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

South Carolina Sales Tax On Cars Everything You Need To Know

Real Estate Property Tax Data Charleston County Economic Development

Property Tax How To Calculate Local Considerations

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Property Tax Calculator Property Tax Guide Rethority

Car Tax By State Usa Manual Car Sales Tax Calculator

Fairfax County Car Tax Bills To Increase For About 12 Of Vehicle Owners News Center