20 year bi weekly mortgage calculator

I 260000 x 00029. The biweekly payments option is suitable for those that receive a paycheck every two weeks.

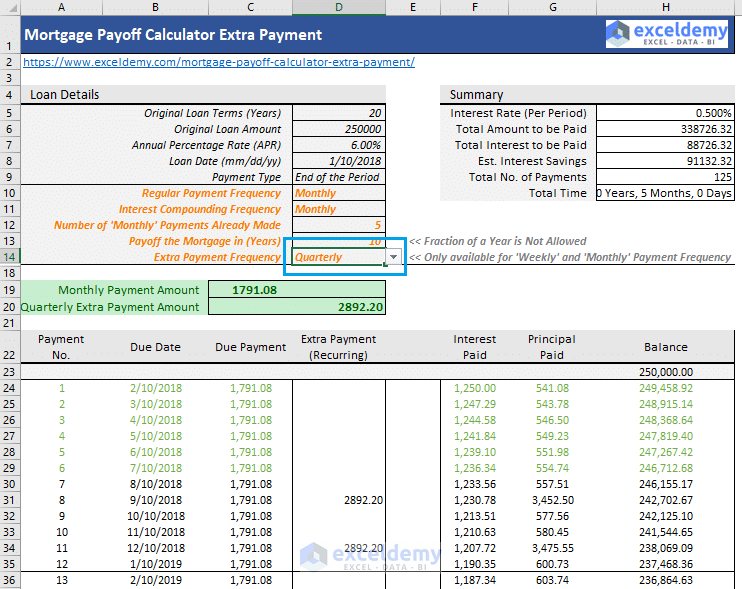

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Or one extra month of payments every year.

. Ad Compare Top Mortgage Refinance Lenders. For example if the required monthly mortgage payment is 3000 the bi-weekly payment is 1500. This simple technique can shave years off your mortgage and save you thousands of dollars in interest.

Get All The Info You Need To Choose a Mortgage Loan. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per.

20-year mortgages tend to be priced at roughly 025 to 05 lower than 30-year mortgages. Bi-weekly Mortgage Payment Calculator. By paying 12 your monthly payment every two weeks each year your mortgage company will receive the equivalent of 13 monthly payments instead of 12.

See how much money you would save switching to a biweekly mortgage. The calculator will figure your bi-weekly mortgage payments for fixed-rate mortgages of up to 40 years. Bi-Weekly Mortgage Payment Calculator.

Biweekly vs Monthly Mortgage Calculator. Your bi-weekly payment will. You can use the following calculators to compare 20 year mortgages side-by-side against 10-year 15-year and 30-year options.

By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. In effect you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow. Use our Bi-Weekly Mortgage Calculator to determine your bi-weekly loan payment as compared to a monthly payment.

In such cases borrowers can allocate a certain. Biweekly Mortgage Calculator This calculator shows you possible savings by using an accelerated biweekly mortgage payment. About us Press room.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. The average interest rate for a 15-year mortgage is currently 523 compared to the 30-year mortgage rate of 603. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information.

This calculator shows you possible savings by using an accelerated biweekly mortgage payment. Biweekly payments accelerate your mortgage payoff. This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. This is a True Biweekly or Simple Interest Biweekly calculator True Biweekly vs Standard Biweekly. Bank Has The Tools For Your Mortgage Questions.

49 rows Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. This calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month and print complete amortization schedules.

Because you make payments every two weeks the required bi-weekly mortgage payment is half the amount of a monthly mortgage payment. Because you make payments every two weeks the required bi-weekly mortgage payment is half the amount of a monthly mortgage payment. However lets say you enrolled in a bi-weekly payment.

Historical 30-YR Mortgage Rates The following table lists historical average annual mortgage rates for conforming 30-year mortgages. A 30 year mortgage when you refinance you may wish to make your new loan term 23 years to stay on track or 15 or 20 years to try to pay. Biweekly Payments Biweekly Mortgage Calculator This calculator will demonstrate how making one half of your mortgage payment every two weeks can save you money in the long run.

This accelerated schedule will amount to one extra mortgage payment per year and you will see how much faster you could have your loan paid off. Biweekly Mortgage Payment Calculator About. Biweekly Payments This free online calculator will show you how much you will save in interest expenses if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once monthly.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Biweekly Payments This calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. This calculator shows you possible savings by using an accelerated biweekly mortgage payment.

Choose The Loan That Suits You. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Mortgage Calculator With Extra Payments Sale 53 Off Www Wtashows Com

Paying Off Mortgage Early Calculator Hot Sale 51 Off Www Wtashows Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Excel Templates Mortgage Payment Calculator Mortgage

Paying Off Mortgage Early Calculator Hot Sale 51 Off Www Wtashows Com

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Bi Weekly Mortgage Payment Calculator

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Payment Plan Bisaver Vs Do It Yourself My Money Blog

Mortgage Calculator How Much Monthly Payments Will Cost

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator

Downloadable Free Mortgage Calculator Tool

Htc8jknkzfke4m

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

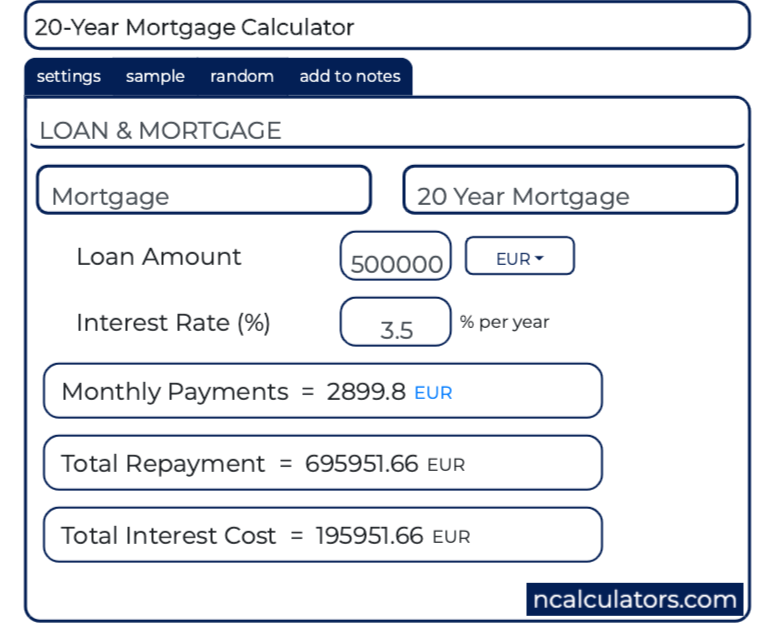

20 Year Mortgage Calculator

Calculate A Car Loan With Bi Weekly Payments Instead Of Monthly Youtube